Pricing

Tailored to your business

- Dedicated Bookkeeper

- Simple, Affordable Pricing

- 100% Tax Deductible

- Cash Basis Accounting

- Dedicated Bookkeeper

- Simple, Affordable Pricing

- 100% Tax Deductible

- Cash Basis Accounting

Essentials

For Startups and Freelancers-

Monthly Bookkeeping & Reports

-

Up to 3 Bank Accounts

-

Up to 100 Monthly Transactions

-

Client Portal Access

-

End of Year Tax Ready Financials

-

Yearly Meeting and Review

-

Unlimited Communication

Standard

For Small Businesses-

Everything in Essentials +

-

Up to 7 Bank Accounts

-

Up to 200 Monthly Transactions

-

Custom Chart of Accounts

-

Financial Document Capture

-

Quarterly Meeting & Review

-

Tracking of 2 Custom KPIs

Professional

For Larger Companies-

Everything in Standard +

-

Up to 10 Bank Accounts

-

Up to 500 Monthly Transactions

-

Multiple Entities

-

Manual Bank Statement Imports

-

Monthly Meeting & Review

-

Tracking of 5 Custom KPIs

Fixed pricing plans are for reference only when your bookkeeping needs fall within that scope of work outlined above. Additional add-ons, services, and specific solutions may be subject to additional charges. Fixed prices may be subject to annual increases with prior notification.

Other Services

Add Ons

Catch up Bookkeeping

Payroll and 1099 Services

Custom Reports and KPIs

Frequently Asked Questions

FAQ

I am behind on my books. Can you help?

Absolutely! Please schedule a free consultation so that we can get started on cleaning/catching up your books. We even offer a discount!

Can I cancel my subscription?

Yes, you can cancel your subscription. Subscriptions must be cancelled before the billable month begins. Cancellations for annual subscriptions will be refunded and prorated according to the month to month billable rate.

How do I pay my Invoice?

We accept payment via check, wire transfer, and all major credit and debit cards. Payment must clear before services are rendered.

Do you assist with Accounts Payable/Receivable?

No, we currently only work on a Cash Basis Accounting, not Accrual. We feel that Accounts Payable/Receivable is better handled by an in-house officer or team member of the company.

Do you offer Tax Preparation Services?

No, we only offer Bookkeeping and Payroll Services. We do however provide the documents necessary for your CPA to file a Tax Return, such as the Income Statement and Balance Sheet. If you do not currently have a CPA we can often recommend qualified tax professionals that can assist you with Tax Filing.

How do I get started?

It’s easy! Click here to fill out the enrollment form or schedule a free consultation with us. We’ll discuss your specific needs and provide a solution to meet your business goals.

Connect with us

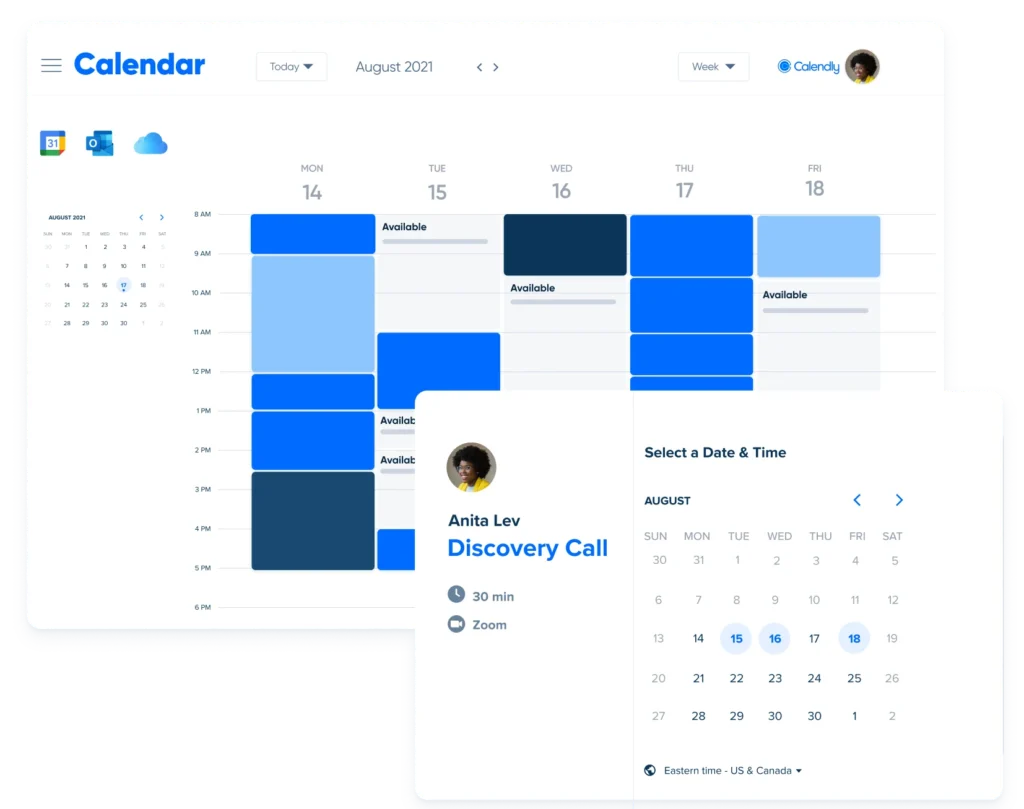

Book a Free Call

Schedule a free consultation with us. We’ll discuss your specific needs and provide a solution to meet your business goals.

- 30 Minutes

- Pick Time & Date

- No Commitment

- 30 Minutes

- Pick Time & Date

- No Commitment